Price deal is a common method to boost sales. Steam push it to an art. There is always a lot of stuff to buy at -50% or even -75%. But is it really so easy? Should you just cut price to increase profitability? How can you really asses the impact of such price deal campaign? Well it’s not that easy and you should rely on analytics to really understand what is happening.

Let’s introduce Mr. Marketing and Mr. Finance

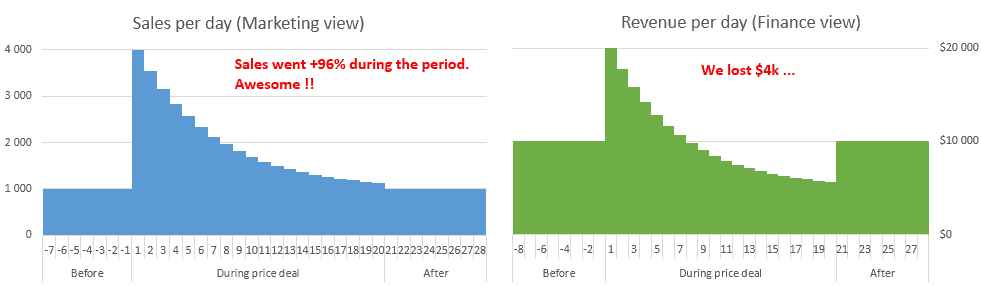

In a price deal operation there are two main KPIs, sales (in units) and revenues (in currency). The figure below show both indicators for a typical price deal operation (-50% over 20 days). First there is a huge spike because people see a bargain. With time, there is less reason for someone not willing to buy the game initially to buy it at a discount. Price deal can have other shapes, but let’s stick with this one.

As you can see, sales are up with an average of +96% during the period. That’s doubling the sales over 20 days, and it’s nice. On the revenue front, things are different, the operation made a $4k loss. As you are selling the product cheaper, you need twice the sales to have the same revenue. Stopping the price deal after 10 days would have made a revenue increase of $30k instead of a loss. That’s one reason why price deal on Steam are very short (offer of the day, offer of the week end, …).

Let’s also note that revenue is not profit (customer selling price is not revenue neither). You can model it and find out that price cut deals are less effective that you might think. If you sell thought many channels that can rise difficulties too.

The good, the bad and the ugly sale

During a price deal you are making 3 types of sales:

- The good : Selling to customers that wouldn’t have bought your product without the sale. That’s what you should target if you can.

- The bad : Selling to customers that would have bought your product during those days anyway. That’s causalities you want to avoid. The simple model above take track of them (in the example above, it’s 1 000 sales a day).

- The ugly : Selling to customers that would have bought your product at full price but later.

The last type of sales is ugly because it’s more difficult to get a sense of the amount. In the example above there is no such sale. You can see that the after sale period is at the same level that the before sale period. An ugly sale would have diminish sales during the after price deal period. On a simple dataset it’s easy to catch, on a real life dataset it’s a bit more tricky.

Sometimes loosing money in the short term is good

When analyzing a price deal, you should not take the sale in isolation but put it in a bigger customer value model. Free to play games are an example of looking at the lifetime customer value. They sell the game for free (permanent -100% price deal) but are making money with up sell (in game items) and cross sell (selling a different production).

For instance, the game Team Fortress 2 is free, but can make money by selling items. If it wasn’t free, it would have a smaller customer base to sell items. Playing Team Fortress 2 also mean you have Steam installed and getting deals every times you want to play, which lead to cross sell.

Having a extensive customer value model can really help in designing good price deal campaign.

Let's stay in touch with the newsletter

October 25, 2013 at 15:28

Price deals are not the precise ways of maximizing sales and profitability. Just by reducing prices, you cannot increase the volume of sales as there are many aspects that can boost sales.

By Market Research Team